Certified Financial Modeling & Valuation Professional (FMVP)

- Immersive Financial Modeling and Valuation Analysis Program

- AI / ChatGPT in MS Excel Curriculum New

- Soft Skills: CV Preparation & Mock Interviews

- Project Work & Certificate

- 100% Placements Assistance

- Weekend and Weekday Batches

Your Doorway to Excellence in Financial Modeling in Delhi!

Discover the world of financial Modeling with our comprehensive Financial Modeling Course in Delhi. At CFI Education, we provide aspiring finance professionals, students, and business enthusiasts with the necessary skills and knowledge to navigate the complex world of financial Modeling. Our programme will provide hands-on experience and practical insights to help you stand out in the competitive finance industry.

Why Choose Our Financial Modeling Course?

- Expert-Led Instructors: Our seasoned instructors bring years of industry experience to the classroom, ensuring you receive excellent guidance and mentorship throughout the course. Learn from the best in the field and gain insights beyond what textbooks can provide.

- Comprehensive Curriculum: The Financial Modeling Course covers various topics, including financial statement Modeling, valuation techniques, scenario analysis, and more. Our programme is a stepping stone to a successful career in finance because we believe in providing you with the skills that matter in real-world scenarios.

- Hands-On Learning: We recognize the value of practical application. Our course emphasizes hands-on learning through case studies, projects, and interactive sessions. Improve your financial Modeling skills in a simulated environment that mimics real-world scenarios.

- Industry-Relevant Tools: Stay ahead of the competition by learning the tools used in the finance industry. Our course includes training on industry-standard software and tools, ensuring you are fully prepared to succeed in your professional endeavours.

- Networking Opportunities: Our extensive networking opportunities allow you to connect with other students, industry professionals, and alumni. Develop a strong professional network, which can lead to exciting career opportunities.

Inspired by our alumni’s success stories, CFI Education is dedicated to providing a transformative learning experience. Our Financial Modeling Course in Delhi is designed to meet the demands of today’s dynamic financial landscape, making it an excellent choice for those looking to advance their careers in finance.

Take the first step towards a fulfilling career in finance. Enrol in our Financial Modeling Course in Delhi today and begin your knowledge, skill development, and professional advancement journey. At CFI Education, we believe in shaping the future and developing financial leaders.

Ready to improve your financial Modeling skills in Delhi? Join CFI Education and make your mark in the world of finance!

Our Alumni Works At

Target Audience

Our training is open to ambitious candidates who come from a range of backgrounds and will typically be

Graduates

Post-Graduates

CA/CFA/ACCAs

Finance Professionals

Investment Professionals

Training Approach

Our training program is blend of Classroom Sessions followed by Project Work and Soft Skill training. Upon Successful completion of all 3 Milestones, candidates become eligible for 4 Milestone that is Placement, and provided support for CV building and Interviews.

01

Classroom

Training

02

Capstone

Project

03

Resume &

Interview Prep

04

Final

Placement

Financial Modeling and Valuation Analysis - Curriculum Highlights

- Using AI and ChatGPT in MS Excel- New

- Keyboard Accelerators and Shortcuts

- Create and Customize the Excel List

- Data entry with Auto Fill Feature

- Working with Advance Cut, Copy, Paste Command

- Use of Find and Replace

- Using Paste Special

- Sorting and Filtering

- Advance Formatting

- Mathematical Functions

- Text Functions

- Statistical Functions

- Date & Time Functions

- Array Functions

- Database and Logical Functions

- Reference and Lookup Functions

- Financial Function

- What if Analysis (Goal Seek, Scenarios, Data Table)

- Pivot Table and Pivot Chart Reports

- Dashboard Creation and Visualization

- VBA Macro Basics

- Most used chart creation including Bar, Stacked, Line, Pie, Waterfall, Football Field etc

- PPT training for writing, formatting and alignment

- Best practices and shortcuts for pitch creation, overview slides, chart pasting

- Introduction to Financial Statements

- Understanding Income Statement, Balance Sheet and Cash Flow and Key Line Items

- Reading, Skipping and Skimming Annual Report

- Understanding Management Discussion & Analysis (MD&A)

- Ratio Analysis and Interpretation

- DuPont Analysis

- Modeling for 3 Financial Statements

- Revenue and Cost Modeling

- Building Supporting Schedule including Depreciation, Working Capital, Debt, Equity, Asset Schedules etc

- Building Scenarios (Base, Best, Worst Cases)

- Maintaining, Updating and Model Adjustments for Corporate Actions (CACS)

- Keeping the Model Dynamic

- Cost of Equity Modeling

- Cost of Debt Modeling

- WACC Calculation Best Practices

- Cash Flow Modeling (FCFF / FCFE) and Terminal Value Calculation

- Approaches to DCF Valuation

- Football Field Analysis and Discussion

- Introduction to Comparable Companies Analysis

- Select the Universe of Comparable Companies

- Locate the Necessary Financial Information

- Spread Key Statistics, Ratios, and Trading Multiples

- Determine Valuation using Comparable Companies

- Adjustment / Normalization of EBIT, EBITDA and Net Income

- Adjustments of Options, Warrants and Restricted Stock Units for Dilution/li>

- Concept of Calendarisation and Last Twelve Months

- Interpreting Results

- Introduction to Precedent Transactions Analysis

- Select the Universe of Comparable Acquisitions

- Locate the Necessary Deal-Related and Financial Information

- Spread Key Statistics, Ratios, and Transaction Multiples

- Benchmark the Comparable Acquisitions

- Determine Valuation using Comparable Acquisitions

- Normalization of EBIT, EBITDA and Net Income

- Interpreting Results

- Introduction to Project Finance

- Sources and Uses of Funds

- IRR, Modified IRR, NPV, Profitability Index and Discounted Payback Period

- Project Finance – Case Study

- Real Estate Modeling – Overview

- Understanding NOI, Cap rate, CoCR, Debt Amortization, among others

- Real Estate Modeling – Case Study

- Use of Financial Models in Pitchbook

- Flow of M&A / Restructuring Transaction

- Introduction to company profile – best practices to follow

- Discussion on live case

- Sector Models – i.e., Retail, Auto, E-Commerce, FMCG, among others

- Statistics Models

- Interest rates and Economics

- Tricky concepts – Levered / Unlevered (Beta, Cash Flow, IRR), TSM, Shares Out vs Weighted Avg Shares

- Doubts and Reference Materials

Post Classroom Sessions, candidates are asked to complete an integrated project covering all the training aspects of program. The project helps candidates get the hold of the concepts and make them aware about best practices.

- Do’s and Don’ts of Interviews Process

- CV Edits and LinkedIn Profile Building

Candidate will have to sit for Mock Interview and clear the rounds to become eligible for placements

Financial Modeling & Valuation - Course Fee

| Classroom / Live Online | Self-Paced | |

|---|---|---|

| INR 40000 | INR 25000 | |

| Classroom / Live Zoom | Yes | – |

| Class Recordings | Yes | Yes |

| Detailed Study Material | Yes | Yes |

| Case Studies | Yes | Yes |

| Capstone Project | Yes | Yes |

| App Access (iOS & Android) | Yes | Yes |

| 100% Placement Support* | Yes | Yes |

| CV & Interview Prep | Yes | Yes |

| Live Doubts Sessions | Yes | – |

| CFI "AI-Coach" | Yes | Yes |

| Whatsapp Group | Yes | – |

| Email Support | Yes | – |

| BUY NOW | BUY NOW |

100% Placement Support*

CFI Education provides placement assistance to all the candidates who complete our in-house Financial Modeling or Investment banking programs. Apart from technical classroom training, we prepare candidates for soft skills, and conduct mock interviews. Once they feel confident, they can start applying for various job opportunities provided by our dedicated placement team. The placement process is usually start at 8th week of the training program.

We charge a placement fee of 5% of annual fixed ctc. This fee is applicable only when candidates is selected through our placement team efforts and accepts the job offer. Contact our team to know more about how CFI Education can help you launch your career in core finance domain.

Success Stories

Students Speak

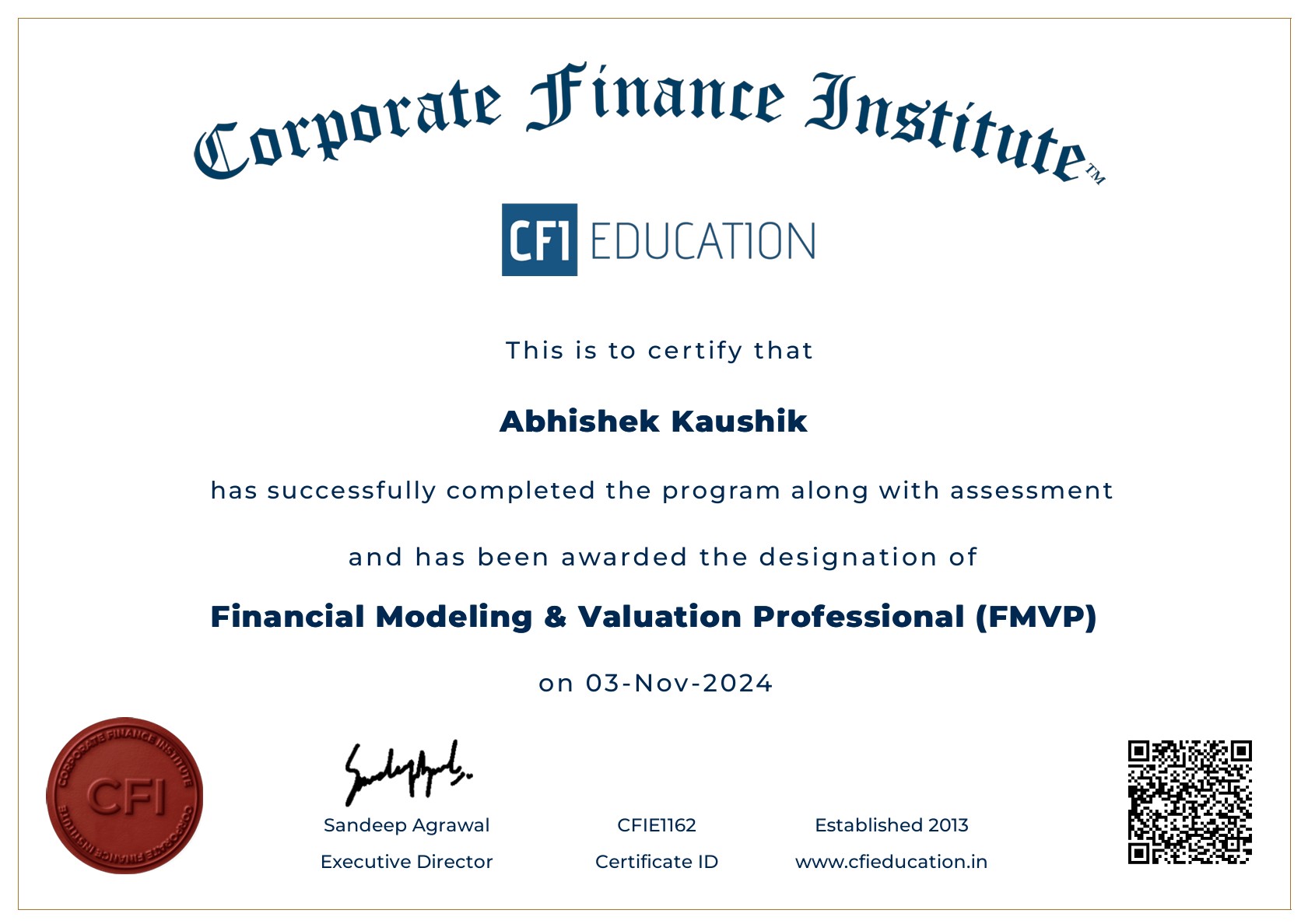

Financial Modeling & Valuation Program - Certification

FAQs — Financial Modeling & Valuation Professional (FMVP) Course

The FMVP course is a professional training program that teaches practical financial modeling, company valuation, Excel mastery, forecasting, and real-world case analysis used by finance professionals across sectors. It blends classroom or live online sessions with project work, soft skills training, and industry-ready applications.

This course is ideal for:

- Graduates and postgraduates interested in finance careers

- Finance professionals seeking advanced modeling skills

- CA / CFA / ACCA candidates enhancing practical competency

- Aspiring investment bankers, equity research analysts, and financial analysts.

You’ll gain industry-ready skills including:

- Advanced MS Excel (including AI/ChatGPT tools)

- Financial statement analysis

- Building 3-statement financial models

- Valuation methods (DCF, comparables, transactions)

- Project Finance Modeling

- Real Estate Modeling

- Pitch and Profile

- Sector Models, Statistics and Economics Basics

- Scenario planning, revenue modelling

- Capstone project and modeling tools used in real finance roles.

The typical structure includes:

- Live classroom or online training

- Hands-on project work

- Soft skills & CV building

- Mock interview sessions

Placement support upon completion The program’s balanced approach prepares you technically and professionally for finance roles.

Yes. Upon successful course completion and assessment, you receive a CFI Certification.

Duration varies by mode (live classroom, online, or self-paced), but typical programs span 2-3 months, depending on batch schedules and pace.

No — while a basic understanding of accounting or finance helps, the FMVP is designed to take you from foundational Excel and financial analysis to advanced modeling and valuation, making it suitable for beginners and experienced learners alike.

On successful completion of all training modules, project work, and evaluations, candidates are awarded a Certificate in Financial Modeling & Valuation Professional (FMVP) — an industry-oriented credential that demonstrates practical competency.

Graduates of the FMVP can target roles such as:

- Financial Analyst

- Investment Banking Analyst

- Equity Research Analyst

- FPA (Financial Planning & Analysis) Specialist

- Corporate Finance Associate

Business and Strategy Analyst These skills are in demand in corporate finance, consulting, banking, and investment firms.

Yes — the FMVP includes 100% placement support to students who complete the training. Placement assistance begins after the technical and soft skills phases, helping you build a professional CV, prepare for interviews, and access job opportunities through the institute’s placement team.

Yes — CFI Education provides placement assistance but charges a placement fee of 5% of your annual fixed CTC only if you are successfully placed through the institute’s efforts and accept the job offer. This makes placement support performance-aligned rather than an upfront cost.

According to the official course details:

- Classroom / Live Online: ~₹40,000

- Self-Paced Learning: ~₹25,000

These prices include training, project work, study materials, case studies, and placement support)

Yes — depending on the chosen mode:

- Live sessions: Live classes, class recordings and study materials, placement assistance

- Self-Paced: Class recordings and study materials, placement assistance

Absolutely — the FMVP integrates real-world case studies and capstone project work giving you practical experience building and analysing financial models that mimic real corporate scenarios.

Yes — the focus on practical skills, real modeling exercises, valuation techniques, and placement support makes it suitable for professionals from non-finance backgrounds seeking to break into finance roles.

Yes — the Financial Modeling & Valuation Professional (FMVP) program from CFI Education provides 100% placement assistance to candidates who successfully complete the training, project work, and interview preparation. The placement support extends across India (PAN India), meaning candidates from different cities and regions (e.g., Delhi, Mumbai, Gurgaon, Bangalore, Hyderabad) can access career opportunities through the institute’s recruitment network once they finish the course.

To register for the FMVP course, follow these simple steps:

- Visit the official course page on the CFI Education website: https://cfieducation.in/financial-modeling-course/

- Review the course details, syllabus, fees, and mode of delivery (classroom or online).

- Click “Enroll Now” or “Buy Now” (depending on your selected mode).

- Complete the registration form with your name, contact details, and academic/professional background.

- Choose your payment method and pay the course fee online.

- Once payment is confirmed, you’ll be contacted and receive a confirmation email with access details, class schedule, and further onboarding instructions.

- Alternatively, you can also connect with the institute’s admissions counsellors via phone or email and they will share payment cum registration link. Visit www.cfieducation.in for counsellors via phone or email