Certified Investment Banking & Research Analyst (CIBRA) In Delhi/NCR

The CIBRA program will help you acquire skillsets needed to enter investment banking jobs. During this program, you will learn:

- Financial Modeling & Valuation

- Merger & Acquisition (M&A), Pitchbook, Fund Raising

- Company Profiles, Industry Analysis

- Equity Research Report Writing

- Interview Soft Skills and CV Building

- AI / ChatGPT in MS Excel Curriculum New

What is Investment Banking?

Investment banking is a branch of a bank or financial institution that provides underwriting (capital raising) and mergers and acquisitions (M&A) advising services to governments, corporations, and organizations. Investment banks operate as go-betweens for investors (those with money to invest) and corporations (those with money to invest) (who require capital to grow and run their businesses). The purpose of this tutorial is to explain what investment banking is and what investment bankers perform.

Roles and Responsibilities of Investment Banking (IB) Analysts

The IB analysts spent a lot of time researching and analyzing company reports, performing due diligence, building Financial Models, performing Trading & Transaction Comps (Relative Valuation), M&A Accretion / Dilution Analysis.

Moreover, IB analysts also involves in preparing Pitchbook, profiles, and marketing materials as well. Pitchbookincludesvarious section including Investment Banks Capabilities (marketing section), competitive landscaping, company profiles, comparable valuation, recent M&A transactions, and Investment Banking recommendations as well.

About Equity Research (ER)

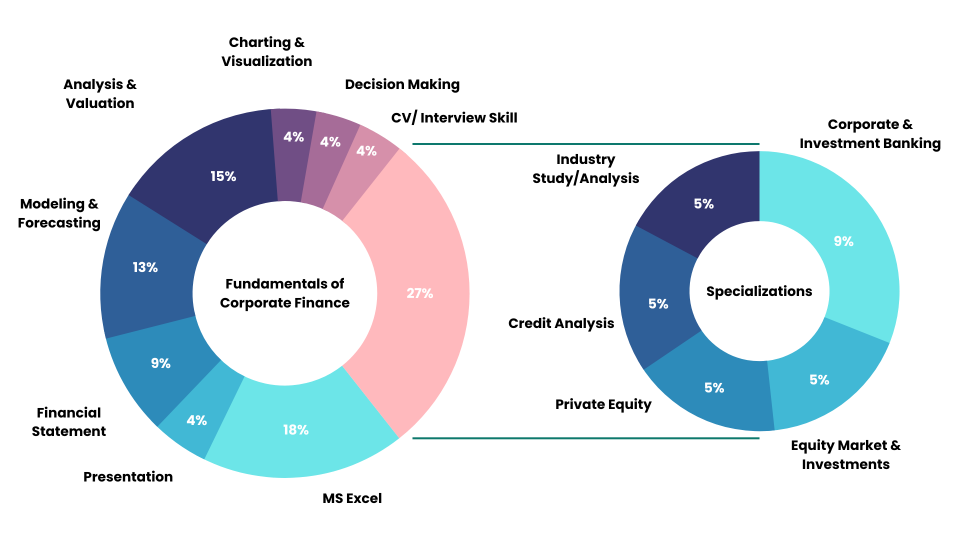

What skills will you develop in this course ?

Our Alumni Works At

Target Audience

Our training is open to ambitious candidates who come from a range of backgrounds and will typically be

Graduates

Post-Graduates

CA/CFA/ACCAs

Finance Professionals

Investment Professionals

CIBRA Program Curriculum

- Using AI and ChatGPT in MS Excel New

- Keyboard Accelerators and Shortcuts

- Create and Customize the Excel List

- Data entry with Auto Fill Feature

- Working with Advance Cut, Copy, Paste Command

- Use of Find and Replace

- Using Paste Special

- Sorting and Filtering

- Advance Formatting

- Mathematical Functions

- Text Functions

- Statistical Functions

- Date & Time Functions

- Array Functions

- Database and Logical Functions

- Reference and Lookup Functions

- Financial Function

- What if Analysis (Goal Seek, Scenarios, Data Table)

- Pivot Table and Pivot Chart Reports

- Dashboard Creation and Visualization

- VBA Macro Basics

- Most used chart creation including Bar, Stacked, Line, Pie, Waterfall, Football Field etc

- PPT training for writing, formatting and alignment

- Best practices and shortcuts for pitch creation, overview slides, chart pasting

- Introduction to Financial Statements

- Understanding Income Statement, Balance Sheet and Cash Flow and Key Line Items

- Reading, Skipping and Skimming Annual Report

- Understanding Management Discussion & Analysis (MD&A)

- Ratio Analysis and Interpretation

- DuPont Analysis

- Types of Capital

- Basic Model – Case Study

- Modeling for 3 Financial Statements

- Revenue and Cost Modeling

- Building Supporting Schedule including Depreciation, Working Capital, Debt, Equity, Asset Schedules etc

- Building Scenarios (Base, Best, Worst Cases)

- Maintaining, Updating and Model Adjustments for Corporate Actions (CACS)

- Keeping the Model Dynamic

- Revenue Model Discussion for Various Industries

- Cost of Equity Modeling

- Cost of Debt Modeling

- WACC Calculation Best Practices

- Time Value of Money Basics

- Cash Flow Modeling (FCFF / FCFE) and Terminal Value Calculation

- Approaches to DCF Valuation

- Football Field Analysis and Discussion

- Introduction to Comparable Companies Analysis

- Select the Universe of Comparable Companies

- Locate the Necessary Financial Information

- Spread Key Statistics, Ratios, and Trading Multiples

- Determine Valuation using Comparable Companies

- Adjustment / Normalization of EBIT, EBITDA and Net Income

- Adjustments of Options, Warrants, RSUs and Convertibles for Dilution

- Concept of Calendarisation and Last Twelve Months

- CACS Discussions

- Interpreting Output Sheet

- Introduction to Precedent Transactions Analysis

- Select the Universe of Comparable Acquisitions

- Locate the Necessary Deal-Related and Financial Information

- Spread Key Statistics, Ratios, and Transaction Multiples

- Benchmark the Comparable Acquisitions

- Determine Valuation using Comparable Acquisitions

- Normalization of EBIT, EBITDA and Net Income

- Control Premium Calculation

- Difference between Trading & Transaction Comps

- Interpreting Output

- Introduction to Project Finance

- Sources and Uses of Funds

- IRR, Modified IRR, NPV, Profitability Index and Discounted Payback Period

- Project Finance – Case Study

- Real Estate Overview

- Understanding NOI, Cap rate, CoCR, Debt Amortization, among others

- Real Estate Modeling – Case Study

- Use of Financial Models in Pitchbook

- Flow of M&A / Restructuring Transaction

- Creation of Deep-dive Company Profile

- Discussion on live case

- Sector Models – i.e., Retail, Auto, E-Commerce, FMCG, among others

- Statistics Models/li>

- Interest rates and Economics

- Tricky concepts – Levered / Unlevered (Beta, Cash Flow, IRR), TSM, Shares Out vs Weighted Avg Shares

- Doubts and Reference Materials

- Introduction to Industry Analysis

- Swot Analysis

- Competitive Benchmarking and Charts Creation

- Sector Index Creation

- Price Chart Creation and Rebasing

- Merger v/s Acquisitions

- Types of Mergers

- Motives behind M&A

- Synergies & Bootstrapping

- Accretion / Dilution Modeling

- Debt Capital Markets (DCM) Overview

- Types of Debt Raise

- Credit Analysis Matrix

- 5 Cs of Credit Analysis

- Debt Covenants

- Ability to pay analysis and Capitalization Table

- Discussion on live case

- ECM Overview, IPO & Global Markets

- Types of Investment Strategies (Active vs. Passive)

- Nifty Index, Asset Allocation & Mutual Funds

- Private Equity Overview

- Private Equity – Understanding & Modeling KPIs

- Introduction to LBO use cases

- LBO Overview and Terminologies

- Past Transactions

- Discussion on live LBO case

- Introduction to Power BI

- Power BI – Desktop Installation

- Power BI Fundmentals

- Dashboard Creation and Visualization – Case Study

- Introduction to Python & Installation

- Python Fundamentals

- Assignments

- Do’s and Don’ts of Interviews Process

- CV Edits and LinkedIn Profile Building

How will the CIBRA program help candidates?

The CIBRA program helps you become a complete Investment Banking and Research Analyst and you will be able to perform:

- Investment Banking Research

- Equity Analysis and Research

- Financial Advisory

- Credit Analysis

- Project Finance Modeling

- Financial Analysis

Careers after obtaining a Certificate in Investment Banking:

Upon successful completion of the program, one may pursue employment in the following fields:

- Investment Banking

- Private Equity

- Corporate Finance and Strategy

- Private Wealth Management

- Equity Research (Buy-Side and Sell-Side)

Certificate in Investment Banking & Research

| Classroom / Live Online | Self-Paced | |

|---|---|---|

| INR 49000 | INR 30000 | |

| Classroom / Live Zoom | Yes | – |

| Class Recording | Yes | Yes |

| Detailed Study Material | Yes | Yes |

| Case Studies | Yes | Yes |

| Capstone Project | Yes | Yes |

| App Access (iOS & Android) | Yes | Yes |

| 100% Placement Support* | Yes | Yes |

| CV & Interview Prep | Yes | Yes |

| Live Doubts Sessions | Yes | – |

| WhatsApp Group | Yes | – |

| Email Support | Yes | – |

| BUY NOW | BUY NOW |

100% Placement Support*

CFI Education provides placement assistance to all the candidates who complete our in-house Financial Modeling or Investment banking programs. Apart from technical classroom training, we prepare candidates for soft skills, and conduct mock interviews. Once they feel confident, they can start applying for various job opportunities provided by our dedicated placement team. The placement process is usually start at 8th week of the training program.

We charge a placement fee of 5% of annual fixed ctc. This fee is applicable only when candidates is selected through our placement team efforts and accepts the job offer. Contact our team to know more about how CFI Education can help you launch your career in core finance domain.

Success Stories

Students Speak

Certifications